Beginning next year, there will be one entertainment provider that receives more than $1 billion annually from Paramount, NBCUniversal, Fox, Disney, Amazon, and YouTube. Oh, they’ll also get about $50 million annually from Apple, which is paying the hefty fee to sponsor 20 minutes of content per year (the Super Bowl Halftime Show).

That provider is the NFL, and its product is very, very, very in demand.

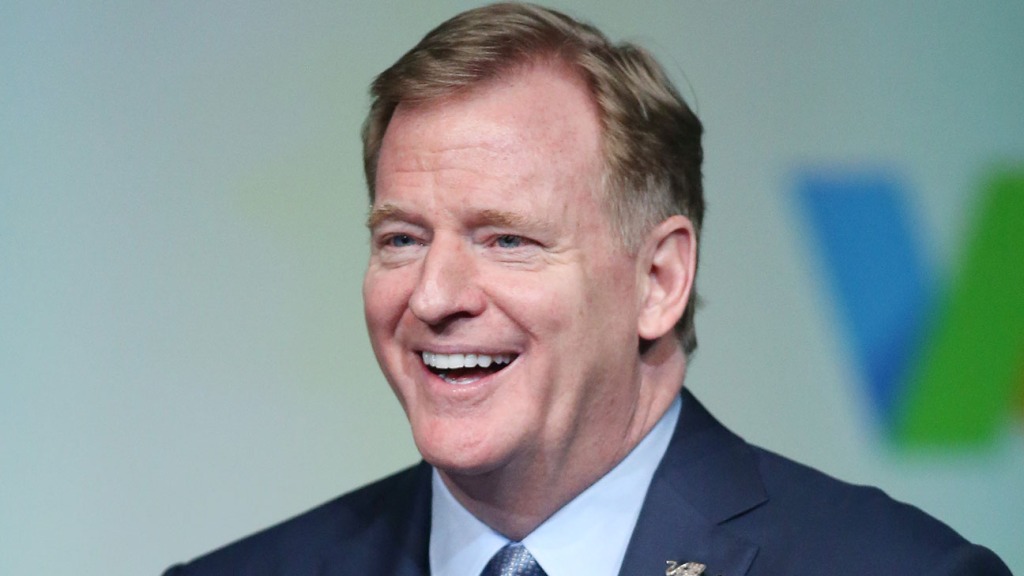

Everyone knows that the NFL, led by commissioner Roger Goodell, is the undisputed king of live TV, with its games across its TV and streaming partners averaging numbers unmatched by anything else (save for an occasional World Cup final or college football game). The league’s newly-announced deal with YouTube for its Sunday Ticket package only underscores its strength.

The NFL will now take in $120 billion over the next decade, not only from legacy TV companies like NBC, CBS, Disney and Fox, but arguably the three most powerful companies in technology today: Apple, Amazon and Google.

With the traditional pay-TV bundle in serious decline (Disney CEO Bob Iger said traditional TV is marching toward a “precipice” earlier this year, and that it will soon be pushed off), it gives the league exposure to companies impervious to those issues … and that may even benefit from it.

“[Sunday Ticket is] a product that’s existed for a long time, but it’s a product that is embarking on its next breakthrough phase in terms of distribution method, and it’s going from a very particular form of satellite distribution to something that’s much more broadly available,” Dhruv Prasad, senior vp of media strategy and strategic investments for the NFL, said in a virtual press conference Thursday.

In a media universe where every company with an attachment to the legacy pay-TV bundle is sweating, not only are those companies seeking optionality (hence the streaming rights baked into the deals), but the league is too. It is entirely possible by the end of the current deal that the cable bundle is a shell of what it is today, and that broadcast networks aren’t the reach machines they have traditionally been.

The 11-year deals inked last year with Paramount, Disney, NBCUniversal, Fox, and Amazon represent a toe dipped into the streaming water (with Amazon’s Thursday Night Football being the biggest test), but the deal with Google’s YouTube is a major expansion of that strategy.

“I don’t know if it’s so much a changing of the guard, but an expansion of distribution and an expansion of the ways in which fans can interact with our sport and our league,” Prasad says. “There’s no question that digital platforms have only increased in audience over the last several years and in our interest at the NFL is getting our content in front of as many fans as possible, and to the extent that fans are assembling on digital, we want to be there in a meaningful way.”

YouTube, which controls the most popular streaming video platform on the planet, and the largest virtual multichannel video provider in YouTube TV, is also being given leeway to innovate, both in product and pricing.

Prasad says that the league wants YouTube to offer Sunday Ticket at an “accessible” price point. “YouTube has the freedom to price the product the way they think the market wants it,” he says.

And the company’s experience in video distribution is a factor as well. The league has made a point of wanting to expand its reach through technology and alternate broadcasts, be that the Manningcast on ESPN2, or Amazon’s X-Ray technology.

It expects nothing less of YouTube.

“I think that was a core part of the appeal of YouTube,” Prasad said. “They have a history of scaled video distribution. They have a history of innovation in both vertical format and horizontal format video, you look at what they’ve done most recently with the launch of YouTube shorts. So I think there’s going to be a tremendous amount coming in terms of innovation and new features around football.”

The future of media consumption is being transformed by technology, and it is very much uncertain. For a sports league dependent on rights fees, that is a scary proposition, laden with risk. The NFL is trying to de-risk itself, cutting deals with its legacy partners, but also making sure that if things do go south in the linear TV business, fans will still be able to watch their favorite team come Sunday afternoon.

You can be sure the other leagues, in particular the NBA, which is about to embark on its rights negotiations, are watching very, very closely.