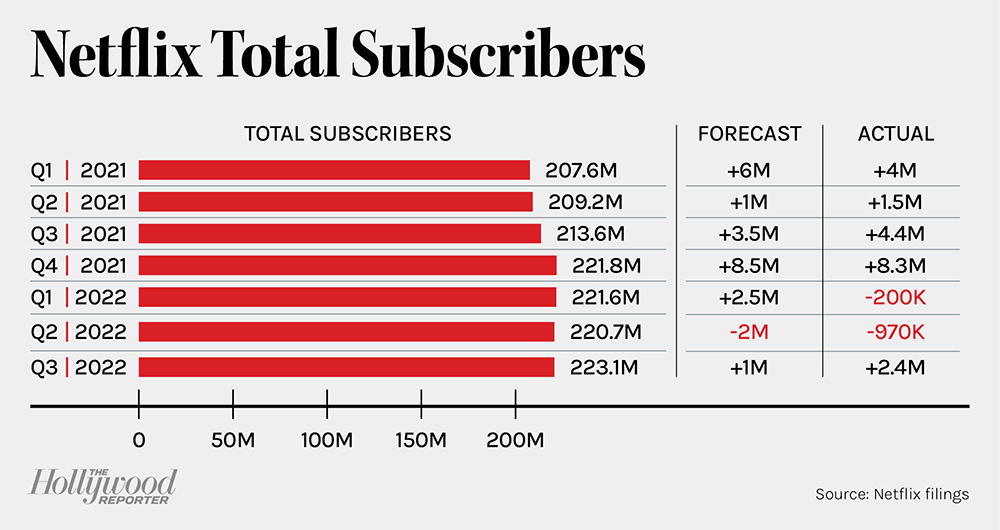

Netflix added 2.4 million subscribers during the third quarter, marking a major turnaround for the streaming giant that has been plagued by declining growth during the past year.

The streamer now has just over 223 million subscribers and is projecting to add another 4.5 million subscribers during the fourth quarter. In the U.S. and Canada, Netflix saw a modest gain of 100,000 subscribers, while the Asia Pacific region contributed 1.4 million paying subscribers. Latin America brought in 310,000 subs, and the EMEA region drove 570,000 of Netflix’s quarterly subscriber adds.

Total revenue during Q3 was $7.92 billion, down slightly from the second quarter but representing a 5.9 percent year-over-year increase.

“Thank god we’re done with shrinking quarters,” Netflix co-CEO Reed Hastings said during the company’s earnings interview. “We’re back to the positivity. Obviously, this quarter and the guidance for Q4 are reasonable — not fantastic, but reasonable. We’ve got to pick up the momentum.”

Tuesday’s earnings represent the first time this year that Netflix has added subscribers. Netflix lost 970,000 subscribers during the second quarter and 200,000 subscribers during the first quarter — losses that sent the company’s stock price downward and resulted in staff morale taking a major hit in light of layoffs and a pullback on company spending growth.

The subscriber losses have also forced the company to turn its attention toward advertising for the first time. Though Netflix previously said it would debut its ad-supported tier in early 2023, the streamer has fast-tracked that timeline and is set to launch an ad-supported subscription tier Nov. 3 for $6.99 a month — about a month before Disney+ will launch its own ad-supported tier for $7.99 a month on Dec. 8.

To that end, Netflix inked a deal with Microsoft to power its advertising tech, enlisted Snap chief business officer Jeremi Gorman and vp sales Peter Naylor to run the initiative, and signed an agreement with Nielsen in the U.S. and the nonprofit BARB in the U.K. to measure viewership for its ad partners.

Other monetization efforts include the streamer’s growing crackdown on account sharing, the latest update of which included a new feature rolled out Oct. 17 that will allow users to transfer their profiles to a new membership account. In a letter to shareholders tied to Netflix’s earnings report, the company said it had “landed on a thoughtful approach to monetize account sharing” that allows for both the profile transfers and for primary account holders to add “sub-accounts,” should they wish to pay for family and friends. Beginning early next year, those changes will roll out more broadly, the letter said.

And, as Netflix redirects its focus toward revenue, the company said it will stop providing paid subscriber guidance beginning next January, when Netflix reports its Q4 earnings. The company will still share guidance for revenue, operating income, operating margin, net income, EPS and fully diluted shares outstanding.

As for Netflix’s games expansion, Netflix now has 35 games available to play, including titles based on The Queen’s Gambit, Nailed It! and Money Heist, as well as a Netflix edition of Oxenfree. Netflix said it has 55 more games in development and has previously said it expects to have more than 50 games available to play by the end of the year.

As Netflix kicks off Hollywood’s third-quarter earnings season, Wall Street’s attention will focus on whether streaming platforms can continue making subscriber gains amid an economic slowdown and executive signaling that content spending will be more disciplined. Since the first day of trading this year, Netflix stock has sunk about 60 percent.