The Walt Disney Co.’s streaming ambitions are at an inflection point.

The company says its flagship Disney+ beat Wall Street expectations by adding 12.1 million subscribers to 164.2 million, and overall streaming subscribers passed 235 million, with Hulu adding 1 million subs in its last quarter, and ESPN+ adding 1.5 million.

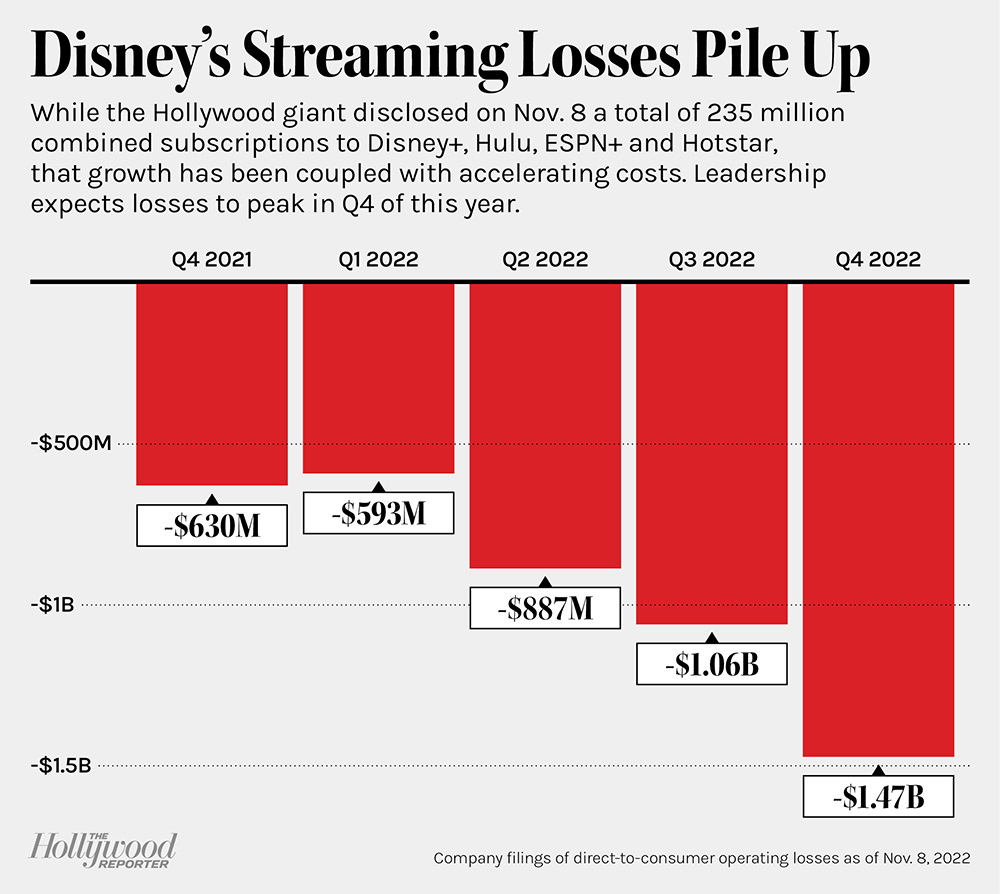

However, streaming losses continue to grow, nearly doubling year-over-year to $1.47 billion. In a statement tied to the company’s fiscal Q4 earnings, Disney CEO Bob Chapek suggested that the company’s streaming losses have peaked, and that it is on a path toward profitability beginning in fiscal 2024.

“The rapid growth of Disney+ in just three years since launch is a direct result of our strategic decision to invest heavily in creating incredible content and rolling out the service internationally, and we expect our DTC operating losses to narrow going forward and that Disney+ will still achieve profitability in fiscal 2024, assuming we do not see a meaningful shift in the economic climate,” Chapek said. “By realigning our costs and realizing the benefits of price increases and our Disney+ ad-supported tier coming December 8, we believe we will be on the path to achieve a profitable streaming business that will drive continued growth and generate shareholder value long into the future.”

Notably, average revenue per user (ARPU) fell at both Disney+ and Hulu, with the company citing more subscribers to the Disney Bundle as one of the reasons.

Hitting that fiscal 2024 profitability target is critical for Disney, which is planning price increases to go alongside its new ad-supported Disney+ tier, both of which should meaningfully increase ARPU. Overall, Wall Street is beginning to look toward profitability in streaming, as the land-grab for subscribers appears to be somewhat subsiding.

Indeed, on the company’s earnings call, Chapek framed streaming losses as being at “a turning point,” and outlined a three-pronged plan for profitability including the higher prices and ad tier, “meaningful rationalization” of marketing spend, and more efficient content spend. Chapek added that the company has locked up more than 100 advertisers for the launch window for the ad-supported tier of Disney+.

Disney CFO Christine McCarthy further said that losses should fall by about $200 million in fiscal Q1, with further improvements to follow in Q2 as the ad tier and price increases fully kick in. She also lowered expectations for substantial Disney+ subscriber additions in Q1, with an acceleration in Q2 due to new international losses.

Overall Disney revenue was $20.1 billion in the quarter, missing Wall Street expectations, with operating income of $1.6 billion.

In the media segment, direct-to-consumer revenues were $4.9 billion in the quarter, up 8 percent year over year, while linear networks revenue was $6.3 billion, down 5 percent year over year. Operating income, however, was up 6 percent at the linear networks, reflecting better results in cable, and “modest” gains in the broadcasting segment.

The results in streaming reflected higher costs at Disney+, and lower results at Hulu, as well as stronger results at ESPN+.

The company also said that its Parks, Experiences and Products division had its best year ever, with $7.4 billion in revenue for the quarter, and $28.7 billion for fiscal 2022, both up mid-double digits, thanks to higher guest spending and volumes, as well as a fully-functional cruise business.

McCarthy said that the company projects fiscal 2023 revenue to to be up high-single digits from 2022, with the caveat that the economic environment remains fluid.

However, McCarthy also warned that the company is also evaluating other places to cut.

“We are actively evaluating our cost base currently, and we are looking for meaningful efficiencies,” she told analysts.